By now, many real

estate professionals and enthusiasts have given us their two cents about the

Perth Street property that received 32 offers and went for $208,725 over asking

last week. It seems that we just can’t resist that "real estate gone

wild" headline. Works every time. But why the huge offer over the asking

price? Well, some real estate salespersons and watchers claim this Perth Street

house was listed well under the market value. If the price was selected based

on the sales of comparable homes in the neighbourhood, the difference between

list price and the sale price may not have been so headline worthy. Still,

there is no ignoring that 32 buyers have tried to buy this one house, and this

lead to one solid fact: there are not enough houses for sale.

Part of this is

seasonal. January does not usually bring a lot of new listings, but this low

inventory of houses has been a chronic Toronto problem for quite awhile. So,

the question becomes: Why are there so few houses available for sale in

Toronto?

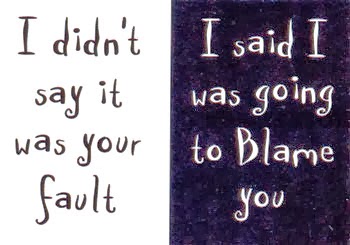

This is where I like to

blame the government. Don't get me wrong. They're not all bad. They can take

some credit for regulating the banks in a way the United States never did,

avoiding a mortgage meltdown and a real estate crisis, and they have put in

some policies that prevent people, who are not ready to buy property, from a

costly mistake. Still, let's not get too smug in our Canadian ways because

government policies often leads to the situation that Toronto is currently in

with no houses to buy, but more buyers in a price range under one million. So,

let's look how the buyers grew and the sellers shank in numbers due to

government policies.

MORE BUYERS. Not too

long ago, the Canadian government said the mortgage insurer, CHMC, would no

longer insure properties over a million. It made sense. CHMC was taking on a

lot of mortgage debt on behalf of Canadians and the government wanted to

lighten their debt load. In Toronto, houses can easily exceed a million in many

upper middle class neighbourhoods like Little Italy, Riverdale or High Park.

Even if you think those neighbourhoods are too fancy for you, let me remind you

that emerging neighbourhoods like Leslieville and the Junction can easily have

homes reach the million dollar mark. And even then, you may be saying "I

have no intention of buying a million dollar house. So, this doesn`t effect me."

The truth is, this policy affects you too.

Out of the buyers who

want to buy a home worth a million dollars or more, some of them will not have

the required 20% down to buy it. So, for those who cannot cover the 20%, they

will be competing with everyone else who wants to buy a house under a million.

At the end of the day, this makes the houses under a million more a lot more

competitive.

LESS SELLERS. It's been

a number of years now that the city of Toronto has begun asking for a land

transfer tax when someone who lives in Toronto buys a property. Buyers used to

only pay the Ontario land transfer tax until the city of Toronto needed more

money. I understand that the city of Toronto needs a revenue source, but by

creating a land transfer tax, the local government almost doubles what a buyer

would pay in taxes if he or she bought a property. The municipal government has

put a huge burden on those who want to sell their properties. Many first time

buyers get a bit of a break on the land transfer tax. So, the burden is not as

big for those buying for the first time around.

If you sell, there's a good chance you'll

purchase another property, whether it's a bigger place for your expanding needs

or a smaller more manageable place. You'll still need the pay big dollars when

you buy again. For example, a reasonable move-up house at $850,000 would mean

$13,475 in Ontario Land Transfer Tax and $12,725 for Toronto Land Transfer Tax

for a combined total of $26,200. That's a lot of money to hand over in addition

to the cost of selling and moving and future renos. The result has been that

people would rather stay put and not sell their home. Thus, we see the

situations where there are less homes for sale.

I don't want to blame

the government for everything, and I don't always disagree with some regulation

of the real estate market. There are a lot of reasons why houses are becoming

more and more expensive. They don't build many houses any more in Toronto.

People want to live in the city again. The commute to the suburbs is too

painful. I can go on. Still, whatever the reason you see, I'd say two things

are clear to me. The government has created policies to cause house prices to

rise, and this year, in most Toronto neighbourhoods, house prices will continue

to rise because of limited listings hitting the market.

No comments:

Post a Comment