Already 2014 is proving to be a stubborn year for buyers, particularly when

it comes to houses. So, some buyers dare to be more creative when it comes to

what they will buy. Sometimes buyers venture into a neighbourhood outside their

original search parameters that is further away but less pricey. Other times,

if buyers would prefer to find a property in a neighbourhood that is a bit

beyond their means, they may turn to one of the "handyman delights"

requiring a complete gut job, which can add up to a 100K plus renovation. If

buyers don't have the renovation funds for such a purchase, they may seek out

an affordable property that costs less because it has a certain reputation.

Well, a bad reputation to be precise. A house that has a sketchy past can seem

like a deal on the surface. But is it?

You should approach stigmatized properties with extreme caution because

they can become more trouble than they are worth. There are risks in buying

these properties. So make sure you research them properly and talk to

neighbours and your real estate salesperson to find out what they know about

the house.

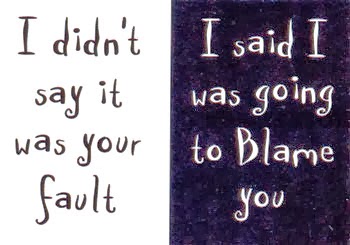

One of the biggest reasons a house may be stigmatized has to do with death.

It's inevitable. People die. We may not want to think about it when we are

buying a home, but it happens in homes. A lot. The truth is, in many houses

that are 80 to 100 years old, there's a good chance that someone may have died

while living there. And most people will be understanding of this. It won't

likely stigmatize a given property to any large degree. It's not the fact that

death has happened, but how death has happened. If a resident of 60 years has

lived to a ripe, old age and died peacefully in their bed, then you are very

likely to find no stigma attached to the house. If there has been a messy

murder in the home, then there is going to be some notoriety to follow that

will linger for some time. If you're one of those people who would not flinch,

and see only a deal on hearing such bloody news, you will likely find a deal

while purchasing. Chances are, however, when you sell your house down the road,

the stigma won't likely go away if the death was brutal or well known. By law,

you must disclose any information about a home that would affect the sale of

the house, like a violent death. So, there is really no way of keeping your

home's stigma a secret when you are selling without some ramifications.

Another big deal, when it comes to stigmatized properties, has to do with

drugs. These days, desirable neighbourhoods that still have some crackhouses

kicking around, are not as big of a deal as they once were, provided you no

longer sAlready 2014 is proving to be a stubborn year for buyers, particularly when it comes to houses. So, some buyers dare to be more creative when it comes to what they will buy. Sometimes buyers venture into a neighbourhood outside their original search parameters that is further away but less pricey. Other times, if buyers would prefer to find a property in a neighbourhood that is a bit beyond their means, they may turn to one of the "handyman delights" requiring a complete gut job, which can add up to a 100K plus renovation. If buyers don't have the renovation funds for such a purchase, they may seek out an affordable property that costs less because it has a certain reputation. Well, a bad reputation to be precise. A house that has a sketchy past can seem like a deal on the surface. But is it?

You should approach stigmatized properties with extreme caution because they can become more trouble than they are worth. There are risks in buying these properties. So make sure you research them properly and talk to neighbours and your real estate salesperson to find out what they know about the house.

One of the biggest reasons a house may be stigmatized has to do with death. It's inevitable. People die. We may not want to think about it when we are buying a home, but it happens in homes. A lot. The truth is, in many houses that are 80 to 100 years old, there's a good chance that someone may have died while living there. And most people will be understanding of this. It won't likely stigmatize a given property to any large degree. It's not the fact that death has happened, but how death has happened. If a resident of 60 years has lived to a ripe, old age and died peacefully in their bed, then you are very likely to find no stigma attached to the house. If there has been a messy murder in the home, then there is going to be some notoriety to follow that will linger for some time. If you're one of those people who would not flinch, and see only a deal on hearing such bloody news, you will likely find a deal while purchasing. Chances are, however, when you sell your house down the road, the stigma won't likely go away if the death was brutal or well known. By law, you must disclose any information about a home that would affect the sale of the house, like a violent death. So, there is really no way of keeping your home's stigma a secret when you are selling without some ramifications.

Another big deal, when it comes to stigmatized properties, has to do with drugs. These days, desirable neighbourhoods that still have some crackhouses kicking around, are not as big of a deal as they once were, provided you no longer sell drugs from the purchased house or have any of the original druggies renting from you. I am sometimes a little surprised at how well a crackhouse can sell in certain neighbourhoods. For the most part, the reputation attached to drugs usually does not have a long term effect on a given house. In most cases, the new people who move in renovate the house so thoroughly that there is no feel for its drug-selling past when they're done. Let's just hope the drug dealers get the memo that your house is no longer the place to pick up the drugs.

Of course, there is one big exception to this rule, and that's grow-ops. Flat out, I would stay away from these. A good home inspector should be able to determine if your home has been used as a grow-op before you buy it. It's not that pot is such a terrible thing, but the growing of it requires a lot of moisture which can create an incredible amount of damage to your home, especially when it comes to mould produced by growing cannabis. It may require extensive work to remove the mould. In some case, the damage is so pervasive, that tearing down your house and starting over may be your best option.

Haunted houses are another one that scare buyers off and may lead to a lower price. I'm not a big believer in ghosts. Even if they did truly exist, I don't think ghosts would be as evil as they are often depicted. So, these stigmatized properties could be a good buy, if you don't believe in them at all. On the other hand, if ghosts are real, you may want to find out if you have something like Casper the ghost instead of Freddie Krueger hiding in your basement. And more importantly, even if you don't find any ghosts in your new house, others may still believe they are there, and if the rumours persist, then the stigma may effect the selling of your house in the years to come.

All in all, there are deals to be had with stigmatized properties, but proceed with caution! Do your research. You need to determine just how stigmatized the property has been in the neighbourhood. Ask the right questions: Will this stigma last? Will it cost you money to renovate and fix the stigma? Can you be comfortable among ghosts? If you pay less now, will it simply mean you just sell for less later? It's up to your level of squeamishness and your willingness to take chances. You may end up with one great deal or you may be making yourself the subject of the next Hollywood horror story - based on a true story!ell drugs from the purchased house or have any of the original druggies

renting from you. I am sometimes a little surprised at how well a crackhouse

can sell in certain neighbourhoods. For the most part, the reputation attached

to drugs usually does not have a long term effect on a given house. In most

cases, the new people who move in renovate the house so thoroughly that there

is no feel for its drug-selling past when they're done. Let's just hope the

drug dealers get the memo that your house is no longer the place to pick up the

drugs.

Of course, there is one big exception to this rule, and that's grow-ops.

Flat out, I would stay away from these. A good home inspector should be able to

determine if your home has been used as a grow-op before you buy it. It's not

that pot iscredible amount of damage to your home,

especially when it comes to mold produced by growing cannabis. It may require

extensive work to remove the mold. In some case, the damage is so pervasive,

that tearing down your house and starting over may be your best option.

Haunted houses are another one that scare buyers off and may lead to a

lower price. I'm not a big believer in ghosts. Even if they did truly exist, I

don't think ghosts would be as evil as they are often depicted. So, these

stigmatized properties could be a good buy, if you don't believe in them at

all. On the other hand, if ghosts are real, you may want to find out if you

have something like Casper the ghost instead of Freddie Krueger hiding in your

basement. And more importantly, even if you don't find any ghosts in your new house,

others may still believe they are there, and if the rumours persist, then the

stigma may effect the selling of your house in the years to come.

All in all, there are deals to be had with stigmatized properties, but

proceed with caution! Do your research. You need to determine just how

stigmatized the property has been in the neighbourhood. Ask the right

questions: Will this stigma last? Will it cost you money to renovate and fix

the stigma? Can you be comfortable among ghosts? If you pay less now, will it

simply mean you just sell for less later? It's up to your level of

squeamishness and your willingness to take chances. You may end up with one

great deal or you may be making yourself the subject of the next Hollywood

horror story - based on a true story!